Free Subscription!

iTunes ![]()

Our podcast will keep you up to date...

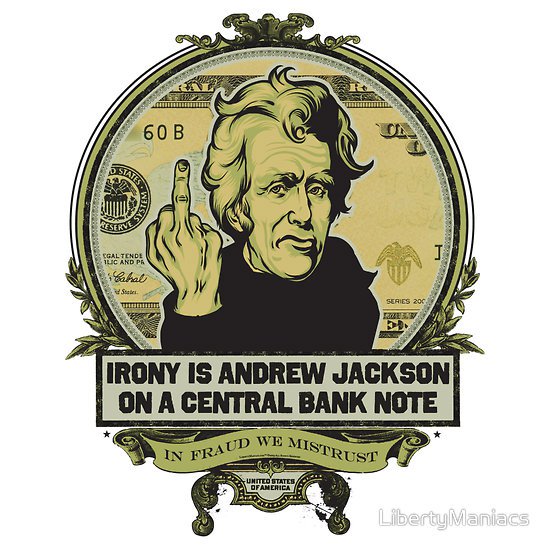

Should the Federal Reserve Be Abolished?

What follows is my entry into the 2011 edition of the Foundation for Economic Education's Eugene S. Thorpe Writing Competition.

According to an e-mail I received on March 7, 2012

Regretfully, the judges have decided not to name a winner this year because none of the entries met their criteria for publication in The Freeman. Thanks for participating in this year's contest."

Although I am disappointed that the Foundation's judges decided that none of the entries met the criteria for publication in The Freeman magazine, I thought that my essay was worthy of sharing with you. I hope you enjoy it.

Should The Federal Reserve Be Abolished?

For a long time my automatic response to this question would be a heartfelt and resounding yes. Having read "I, Pencil" by Leonard Read, and works by Bastiat, Rothbard and others, I would have definitely replied in the affirmative without thinking further on the subject. But now, after a few years of experience, experimentation, and introspection I will do as is suggested by F. Paul Wilson. I will ask the next question.

By whom should the Federal Reserve be abolished?

Should the federal government of the United States of America abolish the Federal Reserve?

In the immortal words of Senator John McCain: I am not a Constitutional scholar. However, having previously taken a strong interest in political matters, I have read that document (purported to be the rules under which the U.S. Federal Government is to operate) on numerous occasions. I find that there is no power enumerated in the Constitution which allows for the creation of such an entity as The FED.

There are a few elected officials and fewer appointed ones at that level that agree with my thinking on this matter. If those agreeable individuals acting as agents of the state (in the generic) are able to persuade the vast majority of their colleagues currently opposed to even basic oversight of the FED, then certainly I will not oppose such a legislative measure.

What if the status quo remains indefinitely?

Many of the agents of the state at the federal level are opposed to ending the FED. It is likely that a few of those elected to the Congress think that they will have to come up with some new system to replace it. Many members of congress (supposedly representatives of the people) may have had a few courses in economics in college, but in totality, have thought very little about economic systems, and they fear the resulting chaos that they feel will surely result from their abolition of the central bank.

For the federal representative, embracing creative destruction is likely a cause of great uncertainty and anxiety. If I were a physician, I would prescribe copious amounts of benzodiazapines, because the uncertainty will only be getting worse. The FED creates uncertainty. The Federal Reserve has no oversight, is not subject to independent audits, and does not issue statements of fiscal condition, as all other banks are required to.

If the status quo reigns, and the federal government continues to maintain its support of the FED, then I'm okay with that. I'll just ask the next question: Should the several states abolish the Federal Reserve?

Most of those elected to states' legislatures probably do not think about the topic of abolishing the FED as it is not within their purview, but a few have. The Utah state legislature, most notably, has passed a bill allowing gold and silver coin to be accepted as payment within its geographical political delineation; provided that the coin has been created by the United States Mint. While far from a free market alternative to the Federal Reserve system, it is at least a legal alternative. Use of coin minted by the United States and sold directly to the people (and state's governments) would avoid the current money being loaned into circulation at interest. If the Utah model becomes widely adopted this will at a minimum provide some competition to the FED, lowering costs and increasing quality for the end users. This I would also certainly not oppose.

Many in the states' legislatures would be afraid of the same changes as those opposed to the end of domestic dollar hegemony at the federal level. They have some other things to fear as well should they step too far astray from Uncle Sam's plantation. First Uncle Sam would threaten to stop funding various programs in the state (Louisiana faced these kinds of threats when considering lowering the minimum age at which alcohol would be legally purchased and consumed).

Most legislators probably won't think beyond this point, but what the heck! Let us go on: What would happen if one (or several) of the various states continued to challenge the status quo by refusing to accept Federal Reserve Accounting Units Denominated? Well then, what is likely to happen is that the Attorney General, acting on orders from the President of the United States Government would have the Governor and supportive state legislators put in the slammer due to violations of federal legal tender laws. If that didn't stop the boycott on Federal Reserve Notes by the state government and general populace, that's when you'd be likely to see some sort of military conflict; but that is pure conjecture and very unlikely to occur in my estimation.

What's that? You want to ask the next question?

Okay then. Ask away.

What if it is not some sort of government that abolishes the Federal Reserve? What if it is individuals that abandon the use of the Federal Reserve Note and it's electronic equivalents?

Well, to my mind this is actually the best way to accomplish the oft chanted "End the FED." This is also the most likely to occur as the tsunamis of quantitative easing desroy the value of the fiat money.

Individuals are always free to set their own standards. For some this will be hard money, like Gold Money, Shire Silver, or American Open Currency Standard copper medallions. For others this will be some other sort of commodity, like seashells, wheat berries, or water molecules. Perhaps a more widely adopted standard could be a cryptography based currency like Bitcoin.

As for me, I aspire to the highest standards within my reach. After all, value is subjective. So if you can't find someone to trade with at your highest standard, hopefully you will heed the wise words of my brother, as he says: "When all else fails, lower your standards."

- FUR3jr's blog

- Login or register to post comments

Thanks for the blog post buddy! Keep them coming... multiple url opner

Thanks a lot for providing individuals with a spectacular possibility to read critical reviews and posts from this site.

motor honda terbaru 2015

Thanks so much! You can play free game there! Love you!

harga ban corsa

Bless you for sharing your info further your blog; this is rudimentary, however incredible doctrine plus look this website. I retain always seen, I cherish it I retain wise something today! Bless for advise. - Design Brochure

Thank you for for sharing so great thing to us. I definitely enjoying every little bit of it I have you bookmarked to check out new stuff you post nice post, thanks for sharing. - parsel lebaran

Great survey, I'm sure you're getting a great response.

farmafeel

This is a very good post. Just wonderful.I think this is among the most vital info for me. And i am glad reading your article. http://www.fifacoingroup.com

I know your expertise on this. I must say we should have an online discussion on this. Writing only comments will close the discussion straight away! And will restrict the benefits from this information. how to correct vision at home

This is my first time visit here. From the tons of comments on your articles,I guess I am not only one having all the enjoyment right here!

watch movies online

Very good written article. It will be supportive to anyone who utilizes it, including me. Keep doing what you are doing – can’r wait to read more posts.

rebous.com

I would be appreciating all of your articles and blogs as a result of their suiting up mark. Denver SEO consulting

Good artcile, but it would be better if in future you can share more about this subject. Keep posting.

www.rebous.com

Great information.

buy retweet

This post has really good & inforamtive thinking about Fedral Reserve. I am agree with you Guys, Thank for discus this topic. latest casual dresses from chunrikurta.com

I always had thought that the Federal Reserve should have been demolished long ago. Why should such a system exist if it contributes only to the expenses of the country? I do not see any point in continuing with the federal reserve

visit this site

Thanks for this post; it’s really amazing to read.

how to make a good persuasive essay

Thank you very much for this useful article. I like it. get the girl code review

This is really quite informative blog such qualitative info I have never seen anywhere. wildlife removal

I would like to thank you for the efforts you have made in writing this article. I am hoping the same best work from you in the future as well.. how can i express my feelings to him

I was going through "moderating" obvious spam posts in this thread, and sad to say I missed muse when they were in Salt Lake City last weekend. battle of the five armies 2014 full movie

I read a article under the same title some time ago, but this articles quality is much, much better. How you do this.. minilader

These are some great tools that i definitely use for SEO work. This is a great list to use in the future.. how do i get a girlfriend if i'm a nerd

Thanks for the post and great tips..even I also think that hard work is the most important aspect of getting success.. e zigarette liquid

This is great blog with its informative knowledge, this webpage really fulfill my need I want to say thanks for this post. custom stickers printing

Just admiring your work and wondering how you managed this blog so well. It’s so remarkable that I can't afford to not go through this valuable information whenever I surf the internet! funny videos of cats talking

This is very interesting content! I have thoroughly enjoyed reading your points and have come to the conclusion that you are right about many of them. You are great.

http://idiscountseo.com.au

I wish more authors of this type of content would take the time you did to research and write so well. I am very impressed with your vision and insight.girlfriend activation system transcript

Thanks for taking the time to discuss this, I feel strongly about it and love learning more on this topic. If possible, as you gain expertise, would you mind updating your blog with more information? It is extremely helpful for me.

girlfriend activation code

Thanks for the post and great tips..even I also think that hard work is the most important aspect of getting success.. buy more facebook fans

Superbly written article, if only all bloggers offered the same content as you, the internet would be a far better place.. girlfriend activation system review

Your website is really cool and this is a great inspiring article. tonic clonic seizure symptoms

This is a great inspiring article.I am pretty much pleased with your good work.You put really very helpful information. Keep it up. Keep blogging. Looking to reading your next post.

carpets

Thanks a lot for this post. I find it very interesting. A small, but growing, number of individuals are not thrilled with the workings or indeed existence of the Federal Reserve. The country's central bank does, after all, set financial policy and figure out the costs of extending credit for banks. However, a bill that would authorize Congress to audit the Fed has just approved the House of Representatives. We should be very careful in choosing our banks to ensure the safety of our hard earned money.

I am very much pleased with the contents you have mentioned.Hologram projection I wanted to thank you for this great article.

Great things you’ve always shared with us. Just keep writing this kind of posts.The time which was wasted in traveling for tuition now it can be used for studies.Thanks the girlfriend system

Im no expert, but I believe you just made an excellent point. You certainly fully understand what youre speaking about, and I can truly get behind that. Find NYC homes

Thanks for sharing the info, keep up the good work going.... I really enjoyed exploring your site. good resource... Ettie

I think this is an informative post and it is very useful and knowledgeable. therefore, I would like to thank you for the efforts you have made in writing this article. iphone news today

I am typically to blogging and i actually recognize your content. The article has actually peaks my interest. I am going to bookmark your web site and maintain checking for brand new information. hot pressing tech

Wonderful article, thanks for putting this together! This is obviously one great post. Thanks for the valuable information and insights you have so provided here. how can i get a popular girl to go out with me

I found your this post while searching for some related information on blog search...Its a good post..keep posting and update the information. nashville seo

This is preeety good one ia m really happy What Is Apple Pay? to found your post. I am found your services i am really like this your post. Thanks

Very interesting blog. Alot of blogs I see these days don't really provide anything that I'm interested in, but I'm most definately interested in this one. Just thought that I would post and let you know. 1800lawyer.biz

I have read a few of the articles on your website now, and I really like your style of blogging. I added it to my favorites blog site list and will be checking back soon. Please check out my site as well and let me know what you think. geoteam.be

I find this post very interesting. Some people are not enamored of the Federal reserve, the independent government bureau that determines the nation's monetary policy and sets interest rates. The House of Representatives has just approved a stringent bill to audit the Federal reserve, though it's not likely to go anywhere. It is very important that we are choosing a reliable, trusted and legitimate bank in saving our hard earned money.

It shuold be abolished.

Thomas Coleman

It was wondering if I could use this write-up on my other website, I will link it back to your website though.Great Thanks. ice cream scoops

Nice Am happy to see your psot. Keep it up . Click Here

This site is really nice post. Keep it up guys and share with me more post in future. Thanks a lot for sharing this post. Gym matting for home gym in cheap price

Its very nice post and i appreciate your effort which you did on this blog. It is really very nice shear and thanks for shearing. used gas generator